BONUS: Agency designed to protect consumers told to do nothing

Louisiana sues New York doctor for providing abortion pills to residents

Please consider supporting The Front Page with a paid subscription: HERE

The Consumer Financial Protection Agency brags on its website it has returned $21 billion in financial relief to American consumers while "making sure you are treated fairly by banks, lenders and other financial institutions."

That has never been more important.

Almost all of us have 401k retirement plans and worry Social Security will not be enough - or won't be there at all - when we retire, so it is paramount to have a watchdog on Wall Street.

The agency was the brainchild of Sen. Elizabeth Warren in the wake of the financial crisis in 2008 when financial institutions gambled away as much as a third of the retirement assets of regular people. It was granted unprecedented independence by Congress so it could do its job.

Republicans made no secret of their dislike of the agency and during Donald Trump's first term in office he installed his former chief of staff Mick Mulvaney as its head and interrupted enforcement actions and slowed its mission.

Rohit Chopra took over the agency after President Biden was elected and was serving a five-year term set to expire in late 2026. He frequently took on big banks and issued regulations that limited overdraft fees, capped credit card late fees and banned medical debt from appearing on credit reports.

Charges we all hate.

The law says his position is protected and cannot be fired.

President Trump fired him this past weekend.

Treasury Secretary Scott Bessent, a millionaire hedge fund manager and the type of person the CFPB was created to protect consumers from, was named acting director of the CFPB Monday morning.

In a two paragraph statement on the CFPB website he said, “I look forward to working with the CFPB to advance President Trump’s agenda to lower costs for the American people and accelerate economic growth.”

In addition to the public announcement, Bessent sent out an internal email (that was shared with National Public Radio) where employees were told to stop doing the bureau work, including issuing or approving proposed or final rules or guidance, and suspending the effective dates of all final rules that have been issued but have not yet become effective. Staff members were also told not to commence or settle enforcement actions, nor to issue any public communications of any type, including research papers.

NPR reported the directive was made "[i]n order to promote consistency with the goals of the Administration.

The goal of the CFPB is to protect consumers' finances.

Bessent's directive was to stop the agency from protecting consumers' finances.

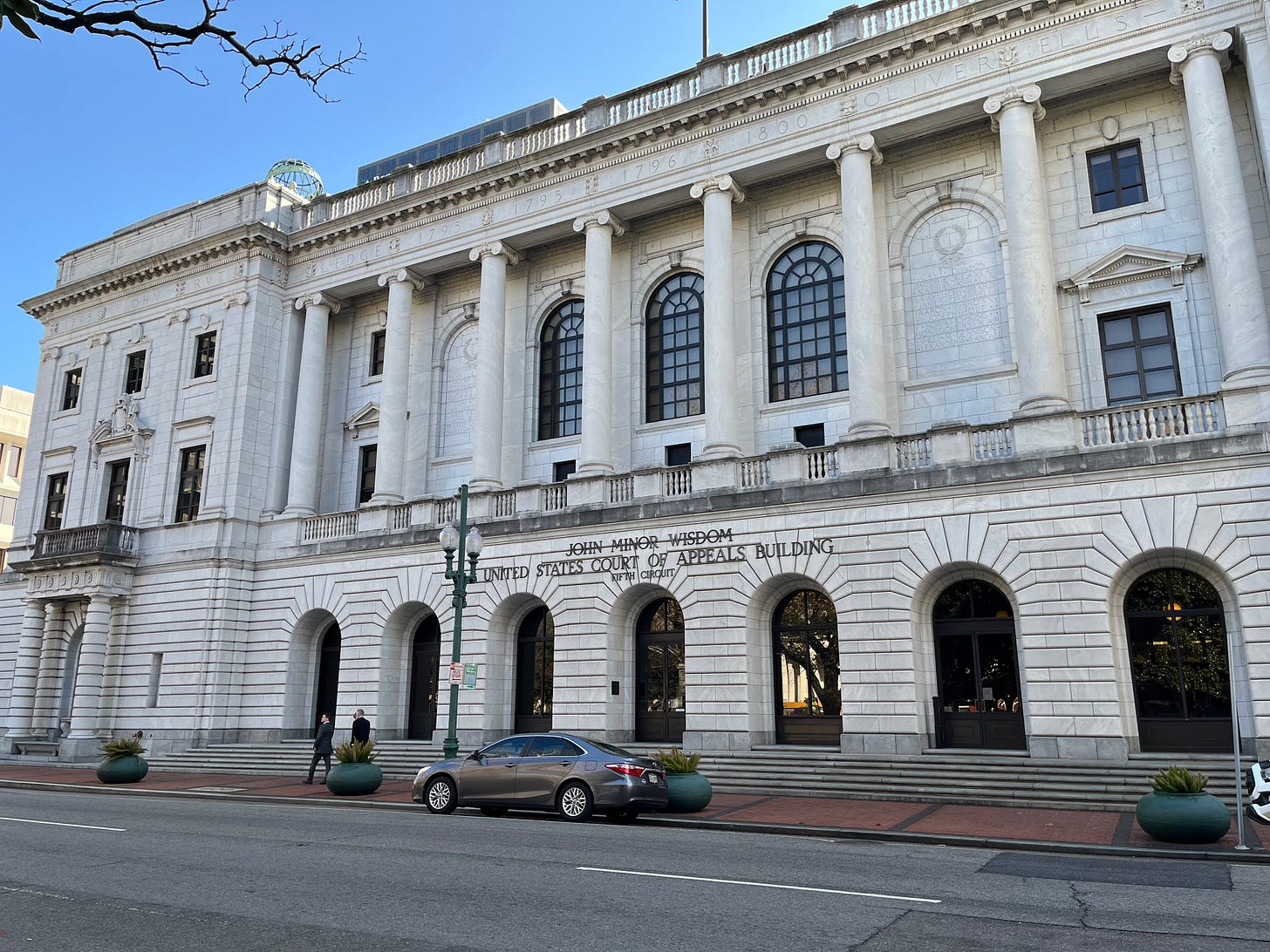

There were two cases involving the Consumer Financial Protection Bureau before the Fifth Circuit Court of Appeals in New Orleans Monday.

The first case seemed frivolous for a court of such statute with the Chamber of Commerce of the United State appealing an earlier ruling that the CFPB could change its "Supervision and Examination Manual" to say that discrimination could be judged an "unfair" labor practice prohibited by law and enforced by the CFPB.

The chamber of Commerce of the United States of American oddly objected and brought a lawsuit, but the Southern District Court of Texas ruled for the CFPB last year.

So with the lawyers and judges in place Monday morning in the ornate En Bank courtroom, the proceeding quickly ground to a stop.

"I'm not sure you need to settle yourself too much," Judge Edith H. Jones told the lawyers before the 2 minute and 20 second hearing began. "My understanding is all you are allowed to do is ask for continuance."

"That's correct your honor," said Justin Sandberg, the senior counsel for litigation and oversight at CFPB. "As a result of the change in leadership this morning, I found out we have been instructed to ask for a pause in litigation to let leadership evaluate the litigation further."

Everyone seems a bit confused about what a "pause" meant or what would happen next.

A "pause" would leave the Chamber of Commerce appeal in limbo and the CFPB standards in place.

Finally, Judge Jones suggested that a "pause" was in order and the lawyers should get together when they knew more.

Later that afternoon, with the Texas Bankers Association fighting an appeal from the CFPB, the same thing played out, only this time after the bankers had spent 20 minutes making their case.

The lawyer for CFPB then told the court it needed to ask for a "pause" because of the change of leadership at CFPB.

Two pauses in one day.

Judge Carl E. Stewart, who was on the earlier panel, recounted his earlier experience that morning and wanted to know the "definition of what a pause is" in the case.

No one seemed to know.

It's a reminder of how intertwined the federal government is when its agencies are involved in enforcement actions involving months and months of work of prosecutors and law enforcement officials to protect American consumers.

It should never just stop.

The fear is that the "pause" will last forever and the Consumer Financial Protection Bureau will cease to exist.

Politico and NPR quickly found consumer groups with concerns.

“There already is massive pressure from Wall Street, predatory lenders, and various billionaires to gut the CFPB and stop it from pursuing its very popular mission of actually doing right by consumers,” Christine Chen Zinner, a senior lawyer for Americans for Financial Reform, said in a statement to the New York Times. “The CFPB was created through legislation passed by Congress and the law gives it a job to do that Bessent is not permitted to simply ignore.”

"While [Trump] parades a crowd of corporate lobbyists, billionaire donors, and Wall Street insiders like Scott Bessent to lead our country, we're looking at the end of basic protections for American consumers," said Tony Carrk of Accountable.US, a corruption watchdog group.

On Tuesday morning, Environmental Protection Agency has a case before the Fifth Circuit Court with the state of Texas. It comes one day after the EPA told 1,100 EPA employees they could be fired.

It also might be a short hearing.

Abortion lawsuit

While the courts are deciding whether a Louisiana law that forces schools to put the Ten Commandments in every classroom in the state, a grand jury in Louisiana has indicted a New York doctor for providing abortion pills to a Louisiana resident which is against Louisiana law.

New York was ready for this and was among eight states to adopt shield laws to protect doctors from out-of-state prosecutions.

Under New York's telemedicine abortion shield law, New York authorities are not obligated to cooperate with prosecutions or other legal actions filed against New York abortion providers by other states.

The Times-Picayune reported that states with shield laws have been sending more than 10,000 abortion pills per month to states with abortions bans or restrictions.

The charges mark a new chapter in an escalating showdown between states that ban abortion and those that want to protect and expand access to it. It is challenging one of the foremost strategies used by states that support abortion rights: shield laws intended to provide legal protection to doctors who prescribe and send abortion pills to states with bans.

Guns on Bourbon Street

With fans from all over the country pouring into New Orleans this week for the Super Bowl, the state is taking extra security cautions in the French Quarter, especially after the attack on New Year's Day.

There will be additional checkpoints on Bourbon Street, bad searches and visitors will have to leave their coolers at home. Bombs were found in coolers on New Year's.

While the coolers are outlawed, firearms will continued to be allowed.

EPA funds

Immediately after taking over the Environmental Protection Agency last week, former New York congressman Lee Zeldin was asked by Democrats why the EPA froze federal funds already approved for grantees for clean energy projects that were already under way.

"Federal law and regulations require that obligated funds be provided to grantees absent proof of misuse of funds,” Senators Sheldon Whitehouse and Bernie Sanders.

wrote to Zeldin, according to Reuters.

Zeldin had no response.

Election delay

Capital Pressroom reported this weekend that Democrats in Albany have been holding closed-door conversations to delay an election to replace Rep. Elise Stefanik in the North Country.

It is unethical display of political might that would be totally unjustified in most times, except that the democracy of our country might be at stake.

Under the guise of increasing voter turnout, the Democrats hope to slow the election process so that the Republicans in Washington have a razor-thin majority.

Ken Tingley spent more than four decades working in small community newspapers in upstate New York. Since retirement in 2020 he has written three books and is currently adapting his second book "The Last American Newspaper" into a play. He currently lives in Queensbury, N.Y.

Speaking of fighting fire with fire, Sen. Brian Schatz, D-Hawaii, is placing a “blanket hold” on President Donald Trump’s nominees for the State Department in protest of Trump dismantling the USAID. This is a Senate tactic used by Republicans to harass Biden's nominees.

It looks like Elise Stefanik's nomination as U.S. Ambassador to the UN may get caught up in this delay.

"Capital Pressroom reported this weekend that Democrats in Albany have been holding closed-door conversations to delay an election to replace Rep. Elise Stefanik in the North Country."

Democrats' conundrum: Fight fire with fire, or bring a knife to a gunfight?